M&A Trends: A Revival Wind Sweeping the Market.

Mergers and Acquisitions (M&A) are a key driver of economic transformation and can be seen as a barometer of global financial health. Their frequency and scale can also reflect the confidence of businesses and investors in the economic environment.

They mirror economic dynamics, innovation trends, and entrepreneurial strategies in response to global challenges and opportunities.

Historically, periods of crisis have often seen a decrease in M&A activities, followed by recoveries marked by strategic consolidations across various sectors. After hitting a low of $1.2 trillion in 2009, the global volume of mergers and acquisitions has consistently exceeded $2 trillion annually since 2014, despite yearly fluctuations.

This pattern repeated with the COVID-19 pandemic, which caused a general slowdown in economic activities, exacerbating uncertainties and complicating the valuation of companies, crucial aspects for M&A decisions. In 2020, global mergers and acquisitions declined by 9.7% to reach $2.2 trillion, down from $2.4 trillion in 2019, thus illustrating the significant impact of the pandemic on this sector.

To illustrate the influence of the economic environment on M&A activities, the example of the hospitality industry is particularly telling. In 2019, this industry saw a significant reduction in transactions, highlighting the direct impact of economic conditions on M&A decisions in this sector.

Indeed, the significant impact of the COVID-19 pandemic on the hospitality industry was manifested by a dramatic drop in revenues, which fell by 46% in 2020 to reach $198.6 billion. This contraction directly affected the mergers and acquisitions market, making assets far less attractive due to their marked depreciation. Concurrently, the sharp decline in valuations led to an estimated 30% decrease in the global GDP of the United States, with considerable financial losses amounting to $2.7 trillion. Major hotel chains also suffered significant financial losses, with companies like Wyndham Worldwide and Marriott International experiencing revenue declines of 36% and 75%, respectively.

2024: A New Momentum?

With forecasts for rate cuts in the United States and a stabilized financing environment, conditions seem ripe for a revival in M&A activities. This revival is seen as essential for global economic transformation.

Key Drivers for M&A Recovery:

- The Role of Inflation and Interest Rates: Improved financial conditions, driven by slowing inflation and anticipated interest rate cuts, play a key role in the resurgence of M&A activity.

- Catch-up in Transactions: A catch-up effect from transactions not completed during the Covid years, or any period of economic instability, is also expected to contribute to market revitalization.

- Strategic Adaptation of Businesses: Companies, facing the need to transform their business models, see M&A as a crucial strategic tool for complementarity or diversification.

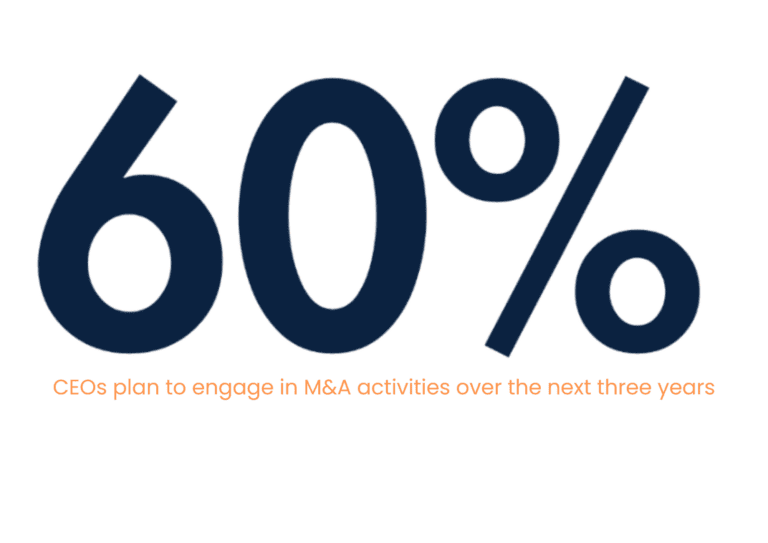

CEOs and private equity funds are seeking ways to rapidly create value. Emerging technologies, decarbonization strategies… M&A is seen as the quickest and most effective means to adapt and transform in response to market changes.

M&A continues to shape the future of industries globally, with the tourism and online mobility sectors in the crosshairs for new strategic and innovative opportunities.

Are you ready for M&A?

Coming soon:

– The secrets to a successful M&A strategy.

– A close look at Travel and Travel tech operations.

– Towards consensual integration plans.

Each topic promises insightful revelations to successfully navigate the complex landscape of M&A.

IMPACT CONSULTANTS and your external growth.

Impact Consultants, Alexandre Veau and Flavie Picart.

References:

PricewaterhouseCoopers. (s. d.). Global M&A Industry Trends 2022. PwC. https://www.pwc.fr/fr/publications/fusions-acquisitions/global-manda-industry-trends-2022-strategie.html

PricewaterhouseCoopers. (s. d.-b). Global M&A Industry Trends : perspectives for 2022. PwC. https://www.pwc.fr/fr/publications/fusions-acquisitions/global-manda-industry-trends-2022.html

Our insights. (2024, 20 février). McKinsey & Company. https://www.mckinsey.com/capabilities/m-and-a/our-insights